Table of Content

Many suppliers offer plans which are assured to pay out the total death profit amount as quickly as the first payment is made and the applying is accredited. This signifies that when you make a single premium payment and then pass away, your beneficiary will obtain the full amount you have been coated for . Once you’ve reached it, you’ll keep your protection, however will no longer should pay premiums. For instance, if you’re capped at $10,000, you won’t should pay any extra premiums once you’ve paid that quantity. If your coverage has an age restrict of 95, your protection will continue once you hit that birthday, but you’ll be done paying any premiums. AARP burial insurance coverage is out there by way of the AARP life insurance program.

These funeral and burial plans are created by insurance coverage firms exclusively for patrons trying to find end-of-life finance for burial and funeral expenditures. Burial insurance coverage safeguards our family members from needing to pay our funeral prices. Compare ultimate expense insurance charges with no obligation to purchase. Information supplied on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be proper on your circumstances. We do not offer financial advice, advisory or brokerage services, nor can we suggest or advise individuals or to buy or promote particular shares or securities.

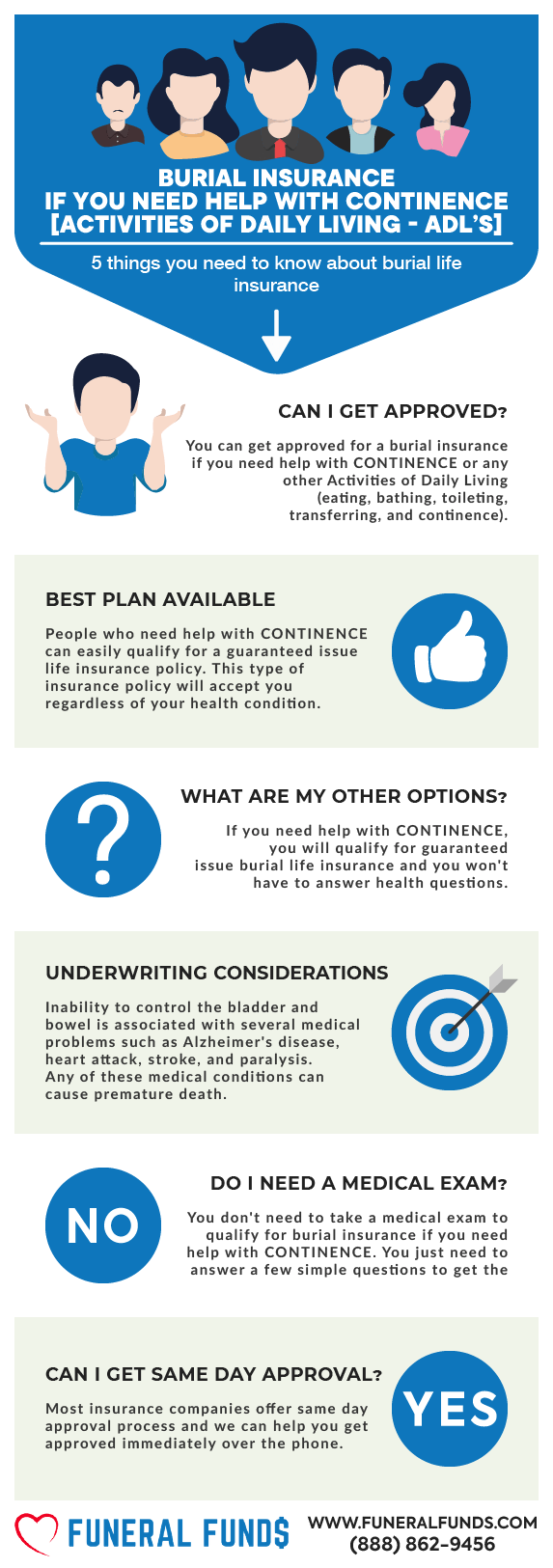

Final Expense Insurance Quotes And Oxygen Use

While we've carried out our best to make sure all rates proven are correct, human error is possible. In the uncommon event of a pricing mistake, the carrier’s rates will at all times supersede whatever value seems on our web site. A listing of the top last expense insurance coverage corporations in the nation and which well-liked firms to avoid. Burial insurance is a really worthwhile purchase should you currently don't have any means to pay in your last expenses. It’s critically important to understand that each insurance coverage company has a unique set of well being questions they ask. Your beneficiaries are entitled to keep any remaining money they don’t use for your final expenses.

When interest rates increase, these policies grow in value, but as they fall, it takes more cash — within the type of greater premiums — to keep them helpful to shoppers. If you have considered one of these insurance policies, you may have the ability to switch its worth to a whole life policy. For essentially the most part, there aren’t household plans for burial insurance coverage. Remember, policies are determined by age and sex, and sometimes the applicant’s well being.

Guide To Funeral And Burial Insurance

They partnered with New York Life, the insurance coverage firm that underwrites the coverage. Mutual of Omaha burial insurance coverage is extra favorable due to its decrease costs. The average cost of a funeral policy is $50-$100 per month for a $10,000 death benefit.

The trustee will use those funds to pay for your funeral costs after you move away. Keep in thoughts, though, that it might take longer for a person to receive a life insurance payout than a funeral insurance coverage payout relying on the insurance coverage company. If you plan on having your funeral bills covered by your life insurance, ensure you realize all of the details about how lengthy it's going to take for your loved ones to receive funds. If your loved one had a burial or funeral insurance coverage to assist cover the price of their funeral, your job might be much easier.

Get Immediate Plan

However, your rate may be higher or lower depending in your insurability elements, including age, well being, gender, state of residence, and the amount of coverage. If you need a ultimate expense policy, make positive to evaluate offers from one of the best burial insurance coverage companies so you'll find a way to isolate which company is best for you. However, you might additionally take out a burial / ultimate expense insurance coverage for the aim of leaving a monetary reward behind to a loved one or charity, to pay off money owed, or for spousal assist. There are “high-risk health issue” carriers capable of provide burial insurance for almost any well being impairment, and many can have a policy in place the identical day protection is requested.

You can take some straightforward and sensible steps to 100 percent guarantee no company or agent scams you. Once claims are permitted, they usually reduce a check equal to the amount of protection you purchased within hours. Of course, this value can vary significantly, depending on the choice of crematory that’s used, and the part of the country and/or metropolis that the cremation takes place in. ” or cash value that you have access to and may use in times of need. And although you may not find your want for oxygen a lot of a frustration or trouble, chances are that there are other points associated to it that can turn out to be a little bit of a headache.

Why Are Last Expense Policies So Beneficial To So Many People?

Once that time frame is up, you will want to buy one other coverage – usually at a a lot larger price – to remain lined. If you don’t renew your coverage and move away, there is not any coverage safety. Because we don’t know when we’re going to die and can’t predict if it's going to occur inside the policy’s term, this isn’t an excellent choice for paying for final expenses.

It’s an entire life insurance coverage that’s purchased in smaller amounts, often, around $5,000 to $25,000. If you need to purchase life insurance purely to cowl your funeral costs, medical payments and different end-of-life bills, look into burial insurance. Also known as ultimate expense insurance, these policies are designed for seniors who need solely a small amount of coverage, and not all insurers provide them.

Why Do I Want Burial Insurance?

This makes it difficult for firms to bundle people collectively in a household plan. Many firms that provide ultimate expense insurance coverage supply a free online quote and allow you to sign up on their websites. You can compare a number of policies from a quantity of firms that will help you narrow down which plan is greatest for you. Pre-need insurance coverage can help people save money by permitting them to pay for services which might be cheaper at present than they are going to be sooner or later. However, when you pay more for your plan than you do for your funeral, your loved ones won’t obtain the difference .

On the other hand, since burial insurance coverage doesn’t pay out a excessive death profit, your beloved ones could probably be on the hook for added bills after you die. Also, since there could be typically no medical examination, you won’t get pleasure from a discounted rate for being healthy, either. Since burial insurance is designed for a specific purpose, it’s not meant to function life insurance for households with main monetary obligations corresponding to a mortgage or faculty tuition. It’s often marketed toward older folks with tight budgets who would otherwise not have the financial savings to cowl burial prices after they die. If you don’t have funds set aside to help your family pay for funeral, medical or different expenses after your demise, burial insurance can be one way to ensure your loved ones can afford those costs. Although payouts from burial insurance can be used for different expenses at the beneficiary’s discretion, profit amounts are tailored to cowl only final arrangements.

Choosing your last arrangements will assist you know what other gadgets you’ll want to contemplate. For a funeral, you’ll wish to think about the cost for a gravestone, casket, and opening and shutting the grave. For a cremation, you’ll want an urn or other container and resolve whether or not you need a memorial service. This is totally the BEST WAY TO SHOP for insurance coverage to cowl your funeral and other last bills.

For the viewing of the body, prices around $1,one hundred according to the cremation research council. The advantages of utilizing oxygen therapy could be fairly profound, and for so much of, they embody life-saving advantages. The agent was nicely knowledgeable in regards to the product and was extraordinarily patient in responding to questions. Your loved ones will most probably obtain the pay-outs inside per week. Your devoted agent will information you through the entire course of to formulate an ideal plan. You will never come throughout any aggressive gross sales or advertising ways as every of our brokers is skilled to depict nothing but sheer grace & regard.

Reach out to the insurance coverage firm the place they took out their policy, and they are going to help you perceive how a lot profit is on the market and the way it might be paid. Because burial insurance is a complete life coverage, it'll last eternally, unlike time period life insurance coverage. Additionally, the insurance value won't ever improve, the death profit won’t decrease, and it builds cash worth. When you die, the life insurance coverage company that issued the protection will provide a quick cash payout (tax-free) to your loved ones or funeral home. Most folks usually use burial insurance coverage to cowl the funeral, burial, and other ultimate bills of a family member or liked one. Permanent life insurance coverage additionally has a money worth that grows over time, which you'll withdraw or borrow against.

No comments:

Post a Comment